The Federal Reserve open market committee has voted unanimously to continue the central bank's easy money policies, again dismissing soaring inflation as 'transitory' and saying COVID-19 still poses risks to the economy.

The 11-member committee voted on Wednesday to keep the federal funds rate near zero and continue flooding the market with money through massive bond purchases 'until substantial further progress' is made on boosting employment.

It comes after the 12-month inflation rate hit 5.4 percent in June, the highest level in 13 years, leading to calls to tighten monetary policy and prevent prices from spinning out of control.

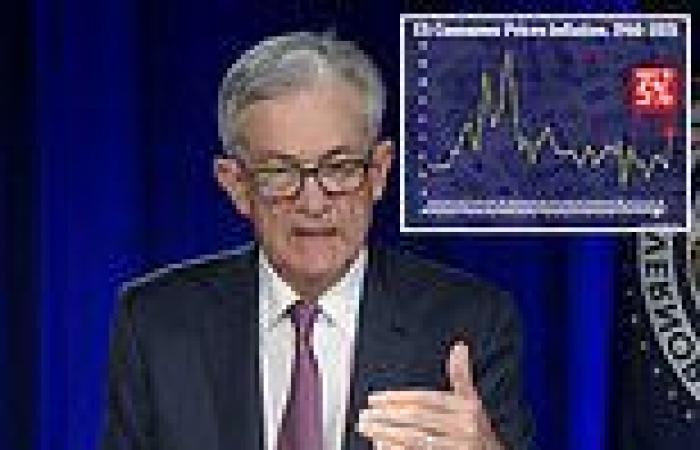

'Inflation has increased notably and will likely remain elevated in the coming months,' Fed Chair Jerome Powell admitted in a press conference, before once again blaming the price hikes on temporary factors such as supply chain disruptions.

Powell said the Fed expects inflation to quickly subside, while also acknowledging 'the possibility that inflation could be higher and more persistent than we expected.'

Fed Chair Jerome Powell still says that inflation will be 'transitory' as the central bank voted unanimously to continue its easy money policy

The 12-month inflation rate hit 5.4 percent in June, the highest level in 13 years

'The path of the economy continues to depend on the course of the virus,' the committee said in a statement.

'Progress on vaccinations will likely continue to reduce the effects of the public health crisis on the economy, but risks to the economic outlook remain,' it added.

The Fed has two central mandates: keeping inflation at 2 percent annually, and achieving 'maximum employment'.

The two mandates often conflict, because the Fed tries to keep inflation in check by raising interest rates, and tries to boost employment by raising interest rates.

The Fed views a controlled amount of inflation as good, because it encourages spending and business investment, rather than hoarding cash.

But out-of-control inflation can be dangerous, eroding the spending power of consumers and hitting low-income families and elderly pensioners the hardest.

The U.S. central bank slashed its benchmark overnight interest rate to near zero last year and continues to flood the economy with money through monthly