By Fiona Parker and Amelia Murray and Helena Kelly For The Daily Mail

All eyes will be on the Bank of England today as it considers hiking interest rates for the first time in more than three years.

Such a move would signal the end of ultra-cheap loans and send up the cost of millions of mortgages in an instant. The bank's base rate has sat at a record low of 0.1 per cent since the beginning of the pandemic in March last year.

At the time, the bank voted unanimously in favour of a cut from 0.25 per cent, to protect households and business from the havoc Covid-19 would soon wreak on the economy.

But with inflation now tipped to soar above 4 per cent, rates may soon need to rise to keep a lid on spiralling prices. Many major banks and building societies have already pulled scores of the cheapest deals from the market in anticipation.

At the start of last week there were 82 mortgages priced at less than 1 per cent. Yesterday there were just 22 left, according to analysts Defaqto. But as prices and taxes rocket, homeowners can still take huge strides to reduce the cost of their largest household bill.

Money Mail tells you all you need to know about what a rate rise would mean for you and when it is worth sticking or twisting:

Tracker tears?

Around 850,000 borrowers are on tracker mortgages which follow the base rate, according to banking trade body UK Finance.

Lenders are required to give base rate borrowers a month's notice before they adjust their repayments.

So, if the base rate is hiked, households on tracker deals will not see their costs increase until next month. The average rate on a tracker deal is currently 2.45 per cent.

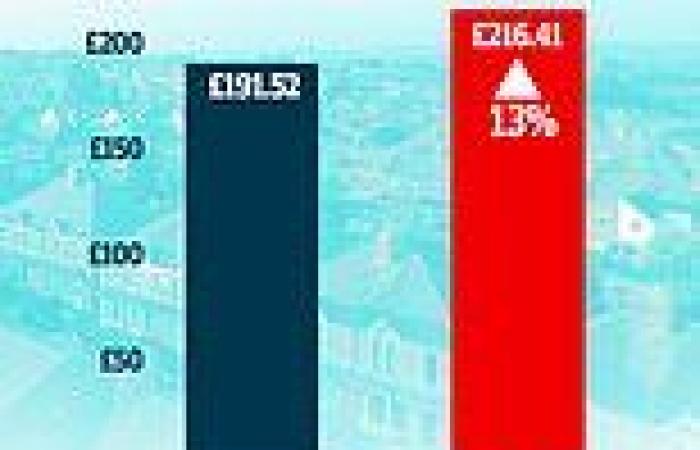

If the base rate was hiked to 0.25 per cent today, it would increase repayments on a £150,000 loan taken over 25 years by £12 a month from £669 to £681 — £144 a year — according to analysis by AJ Bell.

If base rate rose to 0.75 per cent by the end of 2023, the same mortgage would cost £719 a month, an increase of £50 a month or £600 a year.

And if the Office for Budget Responsibility's (OBR's) worst case scenario occurs, where base rate climbs to 3.5 per cent in 2023, the same monthly bill would be £962 — a £3,516 a year jump.

David Hollingworth, of mortgage broker L&C, says: 'Not all trackers tie the borrower in, so homeowners may have an option to jump ship without a penalty and lock into a fix if they are nervous about what the future movement of rates could have in store.'

Variable fright

Standard variable rate households are at the mercy of the lenders as well as the Bank of England.

And this means that the 1.1 million homeowners on these deals could see their rates climb higher than any base rate increase, according to Jane King, a mortgage adviser at Ash-Ridge. Lenders still have to give a month's notice before they alter repayments.

Households are rolled on to more costly standard variable rates when their fixed-term ends. But borrowers who stay on these deals could miss out on savings worth hundreds of pounds a month.

AJ Bell figures show households on Barclays' standard variable rate are paying 4.59 per cent in interest — £841 a month on a £150,000 loan.

If this rate rose in line with the OBR's worst case scenario, repayments could increase to £1,157.

By comparison, HSBC is offering the cheapest two-year fix on the market at 0.99 per cent for borrowers with a 40 per cent deposit.

Switching from Barclays' standard variable rate could bring down monthly payments to £565 — a £5,625 saving over two years after the £999 fee is taken into account.

However, thousands of homeowners are trapped on these expensive rates after changes to affordability rules following the financial crisis.

This means 'mortgage prisoners' could face even harder times if interest rates soar again and they are unable to move to a cheaper deal.

Rachel Neale, of campaign group UK Mortgage Prisoners, says: 'We know of people already on standard variable rates as high as 10 per cent and any base rate hike could be the difference between someone keeping their house or losing it.

'It's a devastating time for mortgage prisoners, some of whom are living off just £300 a month once their repayments are made.'

Tightening up

Competition has led to historically low rates coupled with generous lending. Several large lenders recently announced they would allow wealthy homebuyers to borrow five-and-a-half times their income — a record high.

At the same time, the cost-of-living crisis is expected to hit