Wednesday 22 June 2022 05:35 PM Powell tells senators further rate hikes may be appropriate trends now

Federal Reserve chair Jerome Powell said that inflation was 'certainly high' before Vladimir Putin's war in Ukraine, though the Biden administration often blames the invasion for setting off price increases across the world.

'Would you say that the war in Ukraine is the primary driver of inflation in America?' Sen. Bill Hagerty, R-La., asked Powell. 'No. Inflation was high before, certainly before the war in Ukraine broke out,' the Fed chair said.

Russia is a major exporter of fuel and critical minerals used in electronics, Ukraine is a major exporter of wheat crops. Powell said it would be fair to blame Europe's high inflation on its transition away from Russian oil and gas, but U.S. inflation rates were a more complicated supply and demand issue.

'If you look at comparable large, advanced economies like ours, you'll see inflation rates that are quite similar to ours and some cases higher or some cases lower ... But there are important differences in the characteristics,' he said. 'Ours is more about demand. I would say that for most of the others, theirs is more about energy prices and things like that.'

The White House has frequently focused blame for price increases on the Russian war - in April Biden said that 70 percent of the increase in pricing could be attributed to 'Putin's price hike.'

'We've never seen anything like Putin's tax on food and gas,' Biden lamented during remarks at the Port of Los Angeles earlier this month.

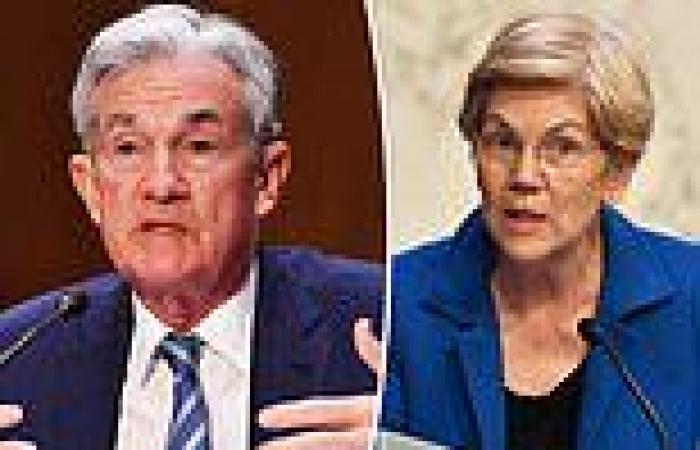

Jerome Powell signaled that further rate hikes are likely as Sen. Elizabeth Warren warned him rate hikes would 'drive this economy off a cliff' in a Senate hearing Wednesday morning

Powell signaled that further rate hikes are likely as Sen. Elizabeth Warren warned him rate hikes would 'drive this economy off a cliff' in a Senate hearing Wednesday morning.

Powell said that rate hikes will be decided on 'meeting by meeting' basis and that the central bank will need to see 'compelling evidence' that inflation is coming down to stop the hikes.

The Consumer Price Index is currently running at 8.6 percent this May over last - the highest in over 40 years. The Fed last week hiked interest rates 0.75 percent, to a range of 1.5 percent to 1.75 percent. Throughout much of the pandemic the Fed kept rates at a near-zero number, insisting that inflation would be 'transitory.'

The stock market has taken a tumble amid the tightening of monetary policy, but Powell said that is because the economy has already predicted that the Fed will drive rates up even higher.

'Financial conditions have already priced in additional rate increases, but we need to go ahead and have them,' he told the Senate Banking Committee.

Sen. Elizabeth Warren then tried to talk Powell out of further rate hikes.

'Will rate hikes bring down gas prices?' she asked. 'I would not think so, no.'

'Will rate hikes bring down food