Saturday 24 September 2022 06:17 PM Liz Truss vows to 'usher in decade of dynamism' as PM defends £45billion tax ... trends now

Liz Truss has said her Government will 'usher in a decade of dynamism' as she defended its controversial raft of tax cuts amid criticism it disproportionately benefits the rich.

In an op-ed for The Mail on Sunday, trailed in The Mail +, the Prime Minister wrote: 'Growth means families have more money in their pockets, more people can work in highly paid jobs and more businesses can invest in their future.

'It provides more money to fund our public services, like schools, the NHS and the police.

'We will be unapologetic in this pursuit... everything we do will be tested against whether it helps our economy to grow or holds it back.'

She added: 'We will usher in a decade of dynamism by focusing relentlessly on economic growth.'

It comes after new Chancellor Kwasi Kwarteng denied 'gambling' with the economy as he revealed £45billion in tax cuts and an estimated £400billion in borrowing over the next five years.

Liz Truss has said her Government will 'usher in a decade of dynamism' as she defended its controversial raft of tax cuts amid criticism it disproportionately benefits the rich

A Treasury minister said the Government is not concerned about the 'politics of envy' as its raft of tax cuts came under fire for disproportionately benefiting the rich.

Labour accused the Prime Minister and the Chancellor of gambling with people's finances in 'casino economics' and said their 'trickle-down' approach will leave the next generation worse off.

Using more than £70billion of increased borrowing, Mr Kwarteng on Friday unveiled the biggest programme of tax cuts for 50 years, including abolishing the top rate of income tax for the highest earners.

The Resolution Foundation said Mr Kwarteng's package will do nothing to stop more than two million people falling below the poverty line.

Analysis of the mini-budget by the think tank said 'only the very richest households in Britain' will see their incomes grow as a result of the tax cuts.

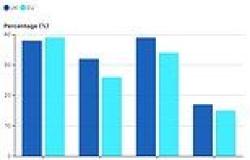

The wealthiest 5 per cent will see their incomes grow by 2 per cent next year (2023/24), while the other 95 per cent of the population will get poorer as the cost-of-living crisis continues.

Labour accused the Prime Minister and the Chancellor of gambling with people's finances in 'casino economics' and said their 'trickle-down' approach will leave the next generation worse off

The Institute of Fiscal Studies (IFS) said only those with incomes of over £155,000 will be net beneficiaries of tax policies announced by the Conservatives over the current Parliament, with the 'vast majority of income tax payers paying more tax'.

IFS director Paul Johnson told BBC Breakfast on Saturday: 'If you've got less than about £150,000 a year coming in, if you're part of the 99 per cent with less than £150,000 coming in, then you're still going to be worse off as a result of tax changes coming in over the next two or three years.'

But Ms Truss defended the tax cuts, saying her Government is 'incentivising businesses to invest and we're also helping ordinary people with their taxes'.

In an interview with CNN, to be aired