What an Australian on an average salary can borrower after eight Reserve Bank ... trends now

An Australian on an average salary has seen their borrowing capacity plunge by almost $140,000 as a result of eight Reserve Bank interest rate rises - making it much harder to buy a house.

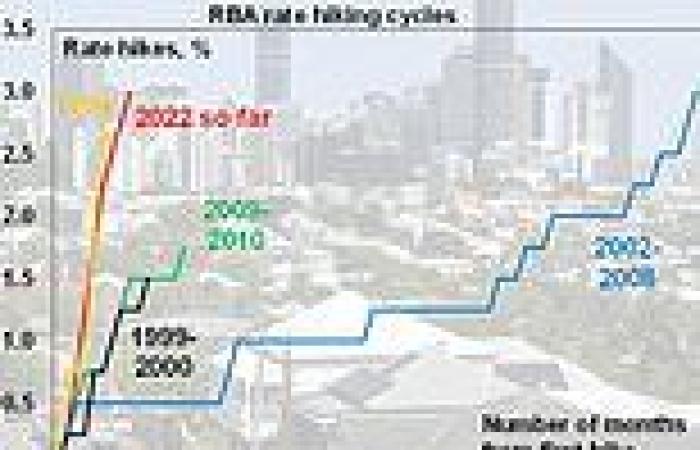

Last Tuesday's 0.25 percentage point increase from the RBA has taken the cash rate to a 10-year high of 3.1 per cent - adding $91 to monthly repayments on an average $600,000 mortgage, with typical borrowers set to pay $934 more than they did in April.

The RBA's eight consecutive monthly rate rises have severely diminished how much the bank can lend prospective buyers.

RateCity calculations obtained by Daily Mail Australia show a worker earning an average, full-time salary of $92,030 has seen their borrowing capacity plunge by $138,900, or 20.3 per cent, since the era of the record-low 0.1 per cent cash rate ended in May.

Back in April, a single professional with no children or other loans could borrow $684,100 but the latest rate rise has reduced that to $545,200.

An Australian on an average salary has seen their borrowing capacity plunge by almost $140,000 as a result of eight Reserve Bank interest rate rises - making it much harder to buy a house (pictured is a Melbourne house)

With a 20 per cent mortgage deposit, the average-income worker can still buy a $681,500 home.

Eight months ago, this same borrower was able to buy a $855,125 house.

This reduced borrowing capacity would still be enough to buy a house in Perth, where $585,989 was the median price in November, but it's below Adelaide's middle price of $702,392, based on CoreLogic data.

It would also make a middle-distance Brisbane suburb out of reach for someone seeking a house, with $798,552 the median price. Typical workers would be priced out of similar suburbs in Sydney and Melbourne unless they bought an apartment.

RateCity's figures are based on the average variable rate with a big four bank rising to 5.01 per cent in December from 2.24 per cent in April, before rates were hiked.

Research director Sally Tindall said the banks had to factor in cost of living increases and rate rises to determine if a borrower could afford to repay a loan.

'With every hike, the maximum amount people can borrow from the bank shrinks because the person will be paying more to their salary to the bank in interest,' she told Daily Mail Australia.

The Reserve Bank's eight rate rises since May have seen repayments on an average, $600,000 mortgage - with the Commonwealth Bank, Westpac, ANZ and NAB - climb by $934, or 40.8 per cent to $3,225 from $2,291.

RateCity research director Sally Tindall said the banks had to factor in cost of living increases and rate rises to determine if a borrower could afford to repay a loan