Plan to change stamp duty in New South Wales kicks in TODAY trends now

As of Monday, stamp duty is optional for first home buyers in NSW on homes costing under $1.5million.

Instead, a first time buyer can choose to pay an annual land tax or stick with paying a one off lump sum stamp duty payment.

The NSW premier says he is focused on creating 'policies for the next generation' as he launches a major overhaul of tax settings for first home buyers in the state.

'We need to think big, do things differently and deliver new policies to drive NSW forward,' Dominic Perrottet wrote in an opinion piece in the Sydney Morning Herald on Monday.

'I want to create policies for the next generation, not the next election.'

But with a state election in less than two months, the reform may not last long.

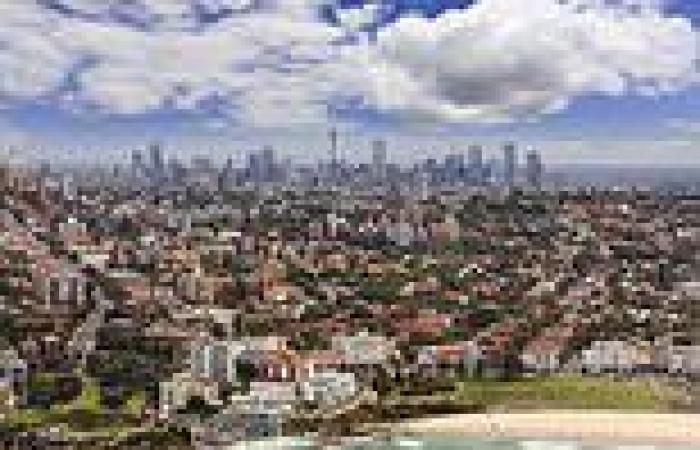

Homebuyers in NSW will no longer have to pay thousands of dollars in stamp duty upfront. Pictured: Bondi Beach

Instead of paying the stamp duty fee up front buyers could chose to pay an annual land tax to the state government instead. Pictured: A home auction in Sydney

Mr Perrottet, who has long been open about his disdain for stamp duty, passed the reform through parliament last year.

The Premier and Treasurer Matt Kean will launch First Home Buyer Choice in south-west Sydney on Monday.

But the opposition Labor party criticised the policy as a broad-based 'forever tax' on the family home, and countered with its own policy, lifting an existing tax-free threshold for first home buyers to all homes and apartments up to $800,000.

Stamp duty would also be partly waived for first home buyers purchasing homes up to $1million under Labor's plan.

With the NSW state election less than 10 weeks away, Shadow Treasurer Daniel Mookhey said Labor had delivered better policy for first home buyers.

'With real wages falling, interest rates rising and tolls exploding, an annual land tax payment will further punish household budgets,' Mr Mookhey said.

'We have the better plan. Tens of thousands of first home buyers get a tax cut,' he added.

'No one will need to worry