Gautam Adani accused of pulling 'the largest con in corporate history' by ... trends now

The world's third-richest man has been accused of pulling of the 'largest con in corporate history' through the Indian-based Adani Group corporation.

US investor Hindenburg Research, which has begun short selling the conglomerate through bonds, conducted a two-year probe into head Gautam Adani, who is worth $125 billion.

The firm alleges that Adani and is family controlled a web of offshore shell accounts that it used to carry out corruption, money laundering and taxpayer theft, all while siphoning money from the companies they owned.

'Adani has pulled off this gargantuan feat with the help of enablers in government and a cottage industry of international companies that facilitate these activities,' the firm wrote in its report published Tuesday.

The Adani Group immediately denied the claims and expressed their shock at the allegations which cost the company $12 billion in market value and saw its flagship firm Adani Enterprises fall nearly 4 percent on Wednesday.

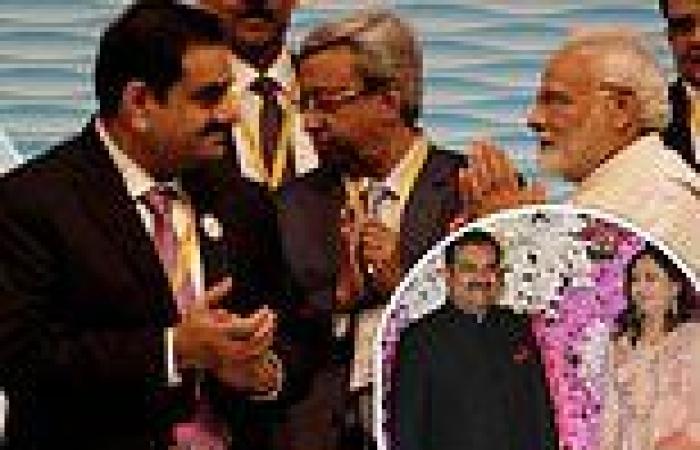

Gautam Adani, the world's third-richest man, was accused of pulling of the 'largest con in corporate history' by famed US investor Hindenburg Research. Adani (left, pictured with wife Priti) is worth $125 billion through the Adani Group conglomerate

Hindenburg's two year investigation alleges Adani, his family and close associates shuffled money around to manipulate stocks and conceal debt. Adani is among the most powerful men in India and remains a close ally of Prime Minister Narendra Modi. The two are pictured in 2019

In its scathing report, Hindenburg questioned how the Adani Group used its offshore entities in tax havens like Mauritius, the Caribbean Islands, and the United Arab Emirates, adding that certain offshore funds and shell companies tied to the group 'surreptitiously' own stock in Adani-listed firms.

The short seller alleged that at least 28 of the shell entities were operated by Adani's older brother, Vinod, or his 'close associates,' as Hindenburg highlighted Indian officials' investigation into fraud allegations against the group.

According to the officials in those investigations, Vinod would move money from offshore entities into private offshore trusts and companies owned by the family. That money would then