Why the latest US interest rate hike means for Australia as America is gripped ... trends now

The latest American interest rate rise could be the last as recent bank collapses stir concerns about global financial market instability - but it could help the Australian dollar.

For Australia, this could see the Reserve Bank pause a planned rate rise in April and reconsider a possible May rate rise.

The US Federal Reserve on Wednesday night raised the key federal funds rate by 0.25 percentage points to 4.75 per cent to 5 per cent.

But in an accompanying statement, US Fed's Federal Open Market Committee predicted banks would be less likely to lend to each other, without specifically mentioning the collapses of Silicon Valley, Signature and Silvergate banks.

'Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation,' it said.

'The extent of these effects is uncertain. The Committee remains highly attentive to inflation risks.'

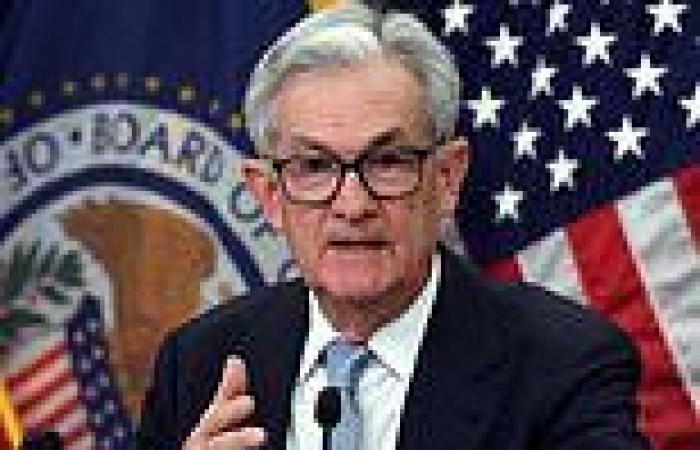

The US Federal Reserve (chairman Jerome Powell, pictured) on Wednesday night raised the key federal funds rate by 0.25 percentage points to 4.75 per cent to 5 per cent but noted 'Recent developments are likely to result in tighter credit conditions for households and businesses'

During the Global Financial Crisis in 2008, concerns about financial instability led to a credit crunch, which was only resolved when the American government bought unwanted corporate bonds at great cost to inject liquidity into financial markets.

Westpac senior economist Elliot Clarke said the US Fed was now more likely to focus on maintain financial stability, even though inflation is still high.

'March's 25 basis point hike is likely to be the last for this cycle as banking sector uncertainty tightens financial conditions and weighs on growth,' he said.

Mr Clarke noted the US