First Republic's collapse was sparked by 'jumbo mortgages' for ultra-wealthy ... trends now

First Republic Bank's collapse was part-triggered by its offer of attractive 'jumbo mortgages' to wealthy clients whose loans were interest-only for up to a decade.

The failed bank sold loans with rock bottom rates to rich clients including Goldman Sachs President John Waldron and music mogul Todd Moscowitz, the former CEO of Warner Bros Records, who both purchased multimillion dollar New York City homes, property records show.

These 'jumbo mortgages', a staple of First Republic's business model for decades, were a great deal for buyers - but became a huge burden for the bank when the Federal Reserve began to aggressively hike interest rates in 2022.

First Republic was essentially sitting on huge losses as it clawed back a measly rate from mortgages worth around $137 billion, while the value of the debt plummeted.

The same market forces contributed to the collapse of Silicon Valley Bank, whose bet on low-interest, long-term bonds backfired when the Fed hiked rates and the value of their investments tumbled.

First Republic Bank was taken over by regulators and will be acquired by JPMorgan Chase after its collapse, which was partly caused by its offer of 'jumbo mortgages' to wealthy clients

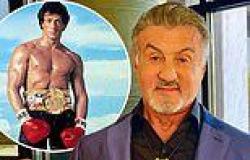

Property records in New York City reveal wealthy figures who've recently taken advantage of First Republic's interest only mortgages include Todd Moscowitz, former CEO of Warner Bros Records

John E Waldron, president and chief operating officer of Goldman Sachs, took out an $11.2m mortgage with First Republic for a New York City apartment. The loans were a great deal for customers but turned into a nightmare for the bank, which lost billions on the low-rate deals

Property records in New York City reveal Goldman Sachs President John Waldron took out a $11.2 million mortgage from First Republic on a condo unit in the luxury 15 Central Park West building.

Waldron purchased the unit in June 2020, when the Fed's interest rate was just 0.08%. The rate of Waldron's mortgage is unclear, but it reportedly had a ten year interest-only period.

In June 2022, music executive Todd Moscowitz snapped up a penthouse in the trendy Manhattan neighborhood of Tribeca with a First Republic mortgage of around $8 million. His loan also had a ten year interest only period.

A Bloomberg analysis found these mortgages were also snapped up by other financial bosses, tech executives and a gallery owner to purchase property in New York City.

First Republic handed out interest only mortgages worth $20 billion in San Francisco, New York and LA alone in 2020 and 2021, the analysis found. Customers actually stood to make money as the value of their properties increased by more than their payments.

The bank was happy to dish out the loans because the borrowers were