Chicago's mayor Brandon Johnson wants to push 'mansion tax' on homes that sell ... trends now

Chicago's mayor Brandon Johnson is pushing a 'mansion tax' on sales of homes of more than $1 million, as his administration continues to push higher tax on households earning over $100,000.

The newly elected Mayor Johnson, who took over from his disastrous predecessor Lori Lightfoot in May of this year, wants to push a hike in taxes in order to fight homelessness in the city.

Allies of Mayor Johnson, 47, have also announced plans to push a $12-billion plan for the city titled 'First We Get the Money'.

The plan, seemingly named after a quote from the 1983 film Scarface, wants to make a 'more just' Chicago by slashing funding for the police and implementing new taxes in the city.

Johnson believes people that own properties worth $1 million in the third-largest city in the U.S. are 'rich, and should pay if they sell those homes'.

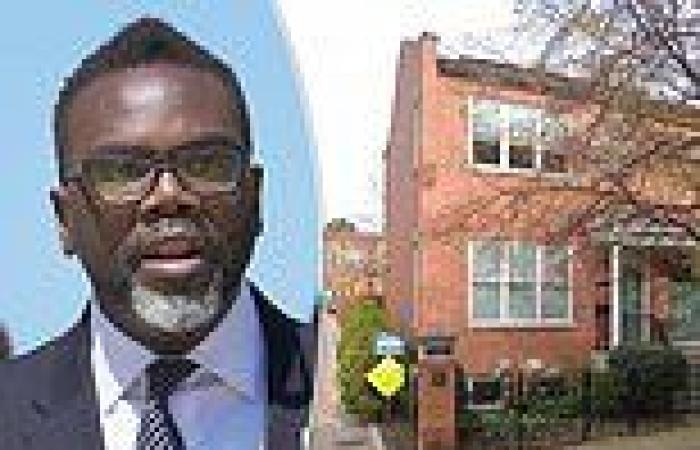

Mayor Brandon Johnson delivers remarks at a press conference at City Hall in Chicago, Illinois, on August 2, 2023

This property in the city is currently on the market for just over $1 million, situated just outside of the city

Property owners who sell their homes for between $1 million and $1.5 million would see tax rates rise from 0.75 percent to 2 percent

The plan, named 'Bring Chicago Home' is a compromise from his previous plan that would have seen the transfer-tax rate triple from 0.75 percent to 2.65 percent.

According to the National Review, Johnson is now proposing a three-tier progressive-transfer rate.

This means that sales below $1 million would see the tax cut from 0.75 percent to 06. percent.

While property owners who sell their homes for between $1 million and $1.5 million would see tax rates rise from 0.75 percent to 2 percent.

Property sales of $1.5 million and above would see their tax rate quadrupled to three percent of the transfer amount.

A search of real estate sites by DailyMail.com showed that it was difficult to find substantial sized properties for over a million dollars, with the majority being condos or small townhouses.

According to Midwest Real Estate Data seen by Chicago Business, there was 2,391 homes sold for $1 million or more in Chicago, down 14.5 percent from the previous year.

Zillow are also currently reporting that the average price of a home in Chicago is $287,709, which is down 1.2 percent over the last year.

Business owners have voiced distaste over additional taxes planned by the ex union organizer, whose upset win this month was achieved thanks to support from figures like Bernie Sanders

Mayor Lori Lightfoot left office earlier this year after losing election in April, she is pictured here in May

Jack Lavin, president of the Chicagoland Chamber of Commerce, told the Chicago Sun Times: 'We remain opposed. Chicago would have the second-highest real estate transfer tax if this passed, compared to