A young Australian crypto fraudster revealed his 'sugar baby addiction' led to the unravelling of his $123million ponzi scheme, which landed him a seven-and-a-half year jail sentence.

Canberra-born Stefan He Qin, 24, was jailed for seven-and-a-half years in December after pleading guilty to securities fraud in New York.

Qin cheated more than 100 investors and used their money to bankroll extravagant parties and pay for a $35,000-a-month penthouse in Lower Manhattan.

In a revealing interview with "EST Media days before he was locked up, Qin said he was corrupted by the money and temptations that were so foreign to his humble upbringing.

'Long story short because my co-founders left now I was the one who was 100 per cent in control of the entire company and if you're 21 years old and you're the only one with access to all these bank accounts that's a recipe for disaster and that's essentially what happened,' he said.

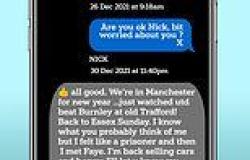

Young Australian crypto fraudster Stefan He Qin revealed his 'sugar baby addiction' led to the unravelling of his $123million ponzi scheme

Qin revealed he was suffering from depression and suicidal tendencies throughout school due to bullying, something he believes fuelled his criminal behaviour.

He said there is an underlying 'insecurity' with Asian Australian culture to become as successful as possible 'at all costs', a trait he kept in the back of his mind throughout his lucrative, criminal career.

The Canberran took a job on a Crypto exchange after 'falling apart' in his first year at the University of NSW in 2015, taking a job with OKCoin, which was the largest trading platform for the currency at the time.

Qin quickly became extremely successful trading Bitcoin across American and Asian markets, buying the coin when it was lower on one continent and selling when higher on another.

His system was then purchased by a hedge fund, Virgil Sigma, the company he was working for while commiting securities fraud.

'I'd be doing the wrong thing but in the back of my mind I thought: 'f**k you, I'm more successful than you',' he said.

He moved into a three-bedroom Lower-Manhattan penthouse that costs $34,000 per month, admitting he only got an apartment with extra bedrooms to accommodate sugar babies.

Canberra-born Qin, 24, was jailed for seven-and-a-half years in December after pleading guilty to securities fraud in New York

Qin said his girlfriend with whom he lost his virginity cheated on him with someone who earned more money, which led to years of trust and commitment issues.

'I lost my virginity in 2017 and I was madly in love, but she cheated on me with some guy who was richer than I was,' he told EST Media.

'You have this beautiful girl you think